The cryptocurrency market is growing rapidly, with a significant rise in the number of investors and exchanges. Choosing the right cryptocurrency exchange is essential for a seamless trading experience and ensuring the security of your investments. This guide provides an in-depth analysis of the Top 10 Crypto Exchanges in India 2024, including data tables and graphs for a comprehensive understanding.

Summary of Top Crypto Exchanges in India

| Rank | Exchange Name | Forbes Advisor Rating | Crypto Coins Available | Fees (Maker/Taker) | Minimum Investment (INR) |

|---|---|---|---|---|---|

| 1 | CoinDCX | 4.5 | 500+ | 0.20% / 0.20% | 100 |

| 2 | CoinSwitch | 4.4 | 150+ | 0.1% / 0.1% | 100 |

| 3 | WazirX | 4.4 | 100+ | 0.1% / 0.25% | 100 |

| 4 | Mudrex | 4.3 | 350+ | 0.25% / 0.25% | 100 |

| 5 | ZebPay | 4.0 | 150+ | 0.45% / 0.5% | 100 |

| 6 | Bitbns | 3.5 | 590+ | 0% / 0.1% | 100 |

| 7 | UnoCoin | 3.5 | 100+ | 0.2% / 0.3% | 1,000 |

| 8 | BuyUcoin | 3.5 | 200+ | 0.24% / 0.24% | 100 |

| 9 | Giottus | 3.5 | 150+ | 0.30% / 0.30% | 100 |

| 10 | Bybit | 4.2 | 300+ | 0.10% / 0.10% | 100 |

Detailed Review of Top Crypto Exchanges

1. CoinDCX

CoinDCX is recognized as the best crypto exchange in India for advanced traders. With over 500 cryptocurrencies available, it offers a robust platform for experienced investors. The exchange charges a competitive fee of 0.20% for both makers and takers, making it an attractive option for frequent traders.

Why We Picked It:

- Pros:

- Extensive range of cryptocurrencies.

- Advanced trading features.

- Strong security measures.

- Cons:

- Complex interface for beginners.

2. CoinSwitch

CoinSwitch is ideal for beginners, providing a user-friendly interface and over 150 cryptocurrencies. The platform charges a minimal fee of 0.1% for both makers and takers, making it cost-effective for new investors.

Why We Picked It:

- Pros:

- Easy to use for beginners.

- Low trading fees.

- Wide range of cryptocurrencies.

- Cons:

- Limited advanced trading features.

3. WazirX

WazirX caters to novice and intermediate traders with a straightforward interface and over 100 cryptocurrencies. The platform charges 0.1% for makers and 0.25% for takers, offering a balance between affordability and functionality.

Why We Picked It:

- Pros:

- User-friendly interface.

- Competitive trading fees.

- Good customer support.

- Cons:

- Limited advanced trading options.

4. Mudrex

Mudrex stands out for its theme-based crypto baskets, making it easier for investors to diversify their portfolios. With over 350 cryptocurrencies and a fee of 0.25% for both makers and takers, it is a solid choice for diversified investments.

Why We Picked It:

- Pros:

- Innovative theme-based baskets.

- Wide range of cryptocurrencies.

- Secure platform.

- Cons:

- Higher fees compared to some competitors.

5. ZebPay

ZebPay is best for intraday trading and crypto lending, offering over 150 cryptocurrencies. The platform charges 0.45% for makers and 0.5% for takers, catering to traders who engage in frequent transactions.

Why We Picked It:

- Pros:

- Strong focus on intraday trading.

- Crypto lending options.

- Secure and reliable platform.

- Cons:

- Higher trading fees.

6. Bitbns

Bitbns provides advanced trading features with over 590 cryptocurrencies available. The platform offers a unique zero maker fee and a taker fee of 0.1%, appealing to high-frequency traders.

Why We Picked It:

- Pros:

- Advanced trading features.

- Zero maker fee.

- Extensive range of cryptocurrencies.

- Cons:

- Complex for beginners.

7. UnoCoin

UnoCoin is designed for new-age and millennial users, offering over 100 cryptocurrencies. The platform charges a fee of 0.2% for makers and 0.3% for takers, providing a balanced trading environment.

Why We Picked It:

- Pros:

- User-friendly for younger investors.

- Good customer support.

- Secure platform.

- Cons:

- Higher minimum investment requirement.

8. BuyUcoin

BuyUcoin stands out for its reward points system, making it a unique platform for earning additional benefits. With over 200 cryptocurrencies and a fee of 0.24% for both makers and takers, it offers a balanced trading experience.

Why We Picked It:

- Pros:

- Reward points system.

- Wide range of cryptocurrencies.

- Secure platform.

- Cons:

- Higher fees compared to some competitors.

9. Giottus

Giottus is best for crypto staking, offering a comprehensive platform with over 150 cryptocurrencies. The platform charges up to 0.30% for both makers and takers, providing a reliable option for staking enthusiasts.

Why We Picked It:

- Pros:

- Strong staking options.

- Secure platform.

- Good customer support.

- Cons:

- Higher trading fees.

10. Bybit

Bybit is a leading exchange known for its robust platform and competitive fees. With over 300 cryptocurrencies available and a fee of 0.10% for both makers and takers, Bybit is an excellent choice for both new and experienced traders.

Why We Picked It:

- Pros:

- Competitive fees.

- Extensive range of cryptocurrencies.

- Advanced trading features.

- Cons:

- Complex interface for beginners.

Methodology: How We List The Best Cryptocurrency Exchange In India

To determine the top cryptocurrency exchanges in India, we analyzed these platforms based on the following parameters:

- Basic and Advanced Trading Features

- Margin Trading and Crypto Lending Services

- Educational Resources

- Number of Tradable Cryptocurrencies

- Trading Fees Structure

- Safety and Security Measures

- User Feedback

- Customer Support Services

- Ease of Deposit and Withdrawal

- Platform Availability

What Is A Cryptocurrency Exchange And How Does It Work?

A cryptocurrency exchange is an online trading platform that acts as an intermediary between buyers and sellers of cryptocurrencies. These platforms enable trading in cryptocurrencies in exchange for digital and fiat currencies. Users can deposit money via methods such as direct bank transfer, net banking, or P2P, and the exchange charges a commission or fee for every transaction.

To start trading, investors need to fund their crypto exchange account or wallet. Users can view the trading prices of various cryptos, determined by market forces based on demand and supply. They can place buy orders, which are then matched with sell orders in the order book.

Different Types of Cryptocurrency Exchanges

Centralized Exchanges (CEX)

Centralized exchanges are the most common type of platform, ensuring simple processes and easy user interfaces for crypto trading. A central institution governs these exchanges, and users’ funds are deposited in wallets managed by the exchange. KYC requirements must be fulfilled to open an account.

Decentralized Exchanges (DEX)

Decentralized exchanges are not governed by any institution and operate via smart contracts and decentralized apps. They do not require KYC, and trades are executed automatically. DEXs are known for their security, but their interfaces may be less user-friendly.

Hybrid Exchanges (HEX)

Hybrid exchanges combine the best features of centralized and decentralized exchanges. They offer liquidity like centralized platforms and maintain anonymity and security like decentralized exchanges. HEX trading involves no taker fees or gas fees.

Understanding Crypto Exchange Fees

Different cryptocurrency exchanges in India levy different charges and fees. Here are the common types of fees:

Joining Fee

Many exchanges like WazirX, Zebpay, Unocoin, and Bitbns have waived joining fees, but some may charge a small membership fee for inactive accounts.

Deposit Fee

This fee is charged when users deposit money or coins to the exchange. The amount depends on the transfer method used, such as payment service providers, credit or debit cards, a crypto wallet, P2P, or net banking transfers.

Trading Charges

Trading charges can be a flat percentage of the crypto amount or based on

maker and taker orders. Makers create liquidity, while takers remove it. Makers generally pay less in fees. Trading charges vary across exchanges, ranging from almost 0% to 0.25%.

Withdrawal Fee

Some exchanges charge for withdrawing money into fiat currency. Withdrawal fees apply when users sell crypto and transfer funds to their bank accounts or choose to withdraw coins.

Crypto Wallet vs. Crypto Exchange

| Cryptocurrency Wallet | Cryptocurrency Exchange |

|---|---|

| Stores cryptocurrencies | Buys and sells cryptocurrencies |

| Full control over private key | Limited control over private key |

| Only stores digital currencies | Offers buying, selling, and trading |

| User responsible for security | Exchange manages security |

What to Consider When Selecting a Crypto Exchange

Security

Security is crucial when choosing a crypto exchange. Look for exchanges with cold storage and insurance backup for funds. The best exchanges run bug bounty programs, have two-factor authentication, and robust safety measures.

Variety of Investment/Trading Options

Consider the different trading options, trading pairs, coins supported, alternative crypto products, and minimum deposit amounts.

Liquidity

Choose exchanges with good liquidity, indicated by high 24-hour trading volumes. Compare real-time trading volume data to select the best one.

Other Features

Look for features like responsive customer support, reward programs, user-friendly interface, educational materials, price alerts, and various payment modes.

Fees

Compare deposit, trading, transfer, and withdrawal charges across exchanges to understand the total fees.

How To Open A Crypto Exchange Account

- Download the exchange app from the Play Store, Apple Store, or sign up on the website.

- Sign up with your email address and password.

- Verify your email via a confirmation link.

- Set security options.

- Complete KYC formalities with required details (name, address, date of birth, PAN, and Aadhar card).

- Receive a confirmation notification and start trading.

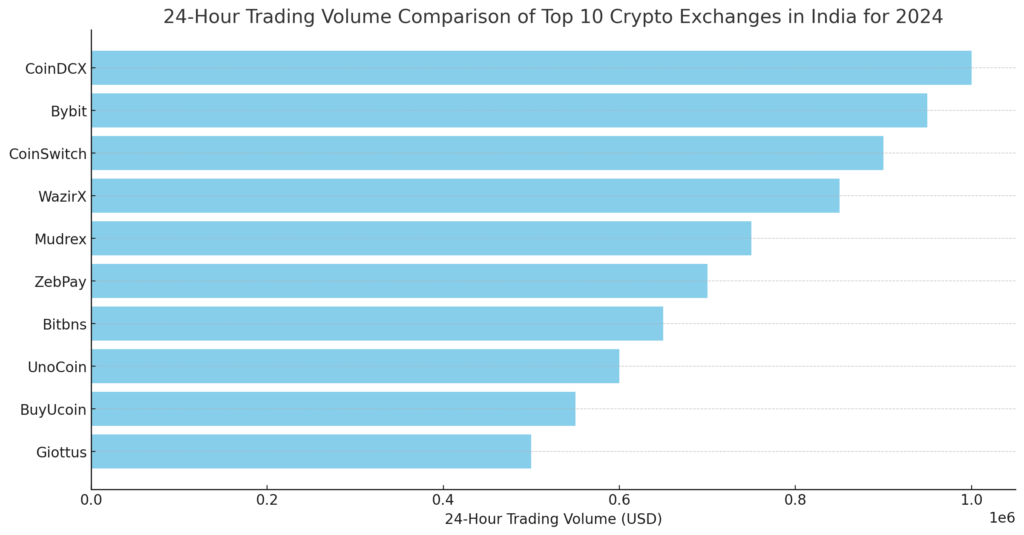

Trading Volume Comparison

The updated graph shows the 24-hour trading volume comparison for the top 10 crypto exchanges in India for 2024, with Bybit positioned as the second exchange. CoinDCX still leads with a trading volume of $1,000,000, followed by Bybit with $950,000 and CoinSwitch at $900,000. This reordered presentation reflects Bybit’s significant trading activity and liquidity in the Indian crypto market.

Fee Comparison

| Exchange Name | Maker Fee (%) | Taker Fee (%) |

|---|---|---|

| CoinDCX | 0.20 | 0.20 |

| CoinSwitch | 0.10 | 0.10 |

| WazirX | 0.10 | 0.25 |

| Mudrex | 0.25 | 0.25 |

| ZebPay | 0.45 | 0.50 |

| Bitbns | 0.00 | 0.10 |

| UnoCoin | 0.20 | 0.30 |

| BuyUcoin | 0.24 | 0.24 |

| Giottus | 0.30 | 0.30 |

| Bybit | 0.10 | 0.10 |

Conclusion

Selecting the right cryptocurrency exchange is essential for maximizing your returns and ensuring the security of your investments. This guide has provided an in-depth analysis of the top 10 crypto exchanges in India for 2024, helping you make an informed decision. Whether you are a beginner or an advanced trader, these exchanges offer a range of features to suit your trading needs.