In the rapidly evolving landscape of digital currencies, staying ahead of the curve with accurate analysis of cryptocurrency market trends and predictions is crucial for both investors and enthusiasts. Understanding the fluctuations and patterns in the crypto market can provide valuable insights, enabling individuals to make informed decisions when it comes to buying, selling, or holding cryptocurrencies. This comprehensive guide delves into World Cryptocurrency Trends and Analysis, the significant developments in the cryptocurrency market in 2024, the factors influencing price movements, emerging technologies, and the potential impact of regulatory changes.

Understanding the Importance of Cryptocurrency Market Trends and Predictions

In the cryptocurrency market, staying informed about the latest predictions and trends is paramount for investors. The landscape is highly dynamic and subject to rapid fluctuations, making it essential for investors to have a comprehensive understanding of market trends and predictions to make well-informed decisions. Here are some reasons why understanding cryptocurrency market trends and predictions is crucial for investors:

Realizing Profitable Opportunities

By analyzing cryptocurrency market predictions and trends, investors can identify potential profit opportunities. Understanding price movements and anticipating market shifts enable them to strategically enter or exit positions, maximizing gains and minimizing risks.

Managing Risk

The cryptocurrency market is notorious for its volatility. Being aware of market predictions and trends allows investors to adopt risk management

strategies effectively. Diversification, hedging, and timing investment decisions become more informed when backed by reliable market analysis.

Staying Ahead of the Competition

In the competitive world of cryptocurrencies, being one step ahead can be a game-changer. By keeping abreast of market predictions and trends, investors can differentiate themselves from the crowd and make well-timed moves to capitalize on emerging opportunities.

Navigating Regulatory Impact

Cryptocurrency markets can be influenced by regulatory developments. Investors can anticipate potential regulatory changes and their impact on the market, allowing them to adjust their strategies accordingly.

Evaluating Long-Term Viability

A deep understanding of market predictions and trends enables investors to assess the long-term viability of different cryptocurrencies. By scrutinizing the technological foundations, use cases, and community support, investors can identify projects with sustainable growth potential.

Supporting Informed Decision-Making

Knowledge of the market provides investors with a solid foundation for decision-making. Rather than relying solely on emotions or hearsay, they can make data-driven and rational choices aligned with their investment goals.

Maximizing Return on Investment

In the volatile cryptocurrency market, timing is crucial. Analyzing the market helps investors to buy at advantageous price levels and sell when assets are peaking, thus maximizing their return on investment.

Key Factors Shaping the Cryptocurrency Market

In analyzing cryptocurrency market trends and predictions, several key factors play a pivotal role in shaping the volatile and dynamic nature of the market. Understanding these factors is essential for investors seeking to navigate the complexities of the cryptocurrency landscape with confidence. Let’s delve into the significant factors that influence the cryptocurrency market and impact predictions.

1. Technological Advancements and Innovation

The rapid pace of technological advancements significantly influences cryptocurrency market trends and predictions. Innovations such as blockchain upgrades, the rise of decentralized finance (DeFi), and the emergence of non-fungible tokens (NFTs) drive shifts in market sentiment and investment strategies. Investors must keep a close eye on these technological developments to gauge their potential impact on the market’s future.

2. Regulatory Landscape and Legal Frameworks

Regulatory developments have a profound effect on cryptocurrency market trends and predictions. Governments’ stances on digital assets, taxation policies, and the introduction of legal frameworks impact market sentiment and investors’ confidence. Changes in regulations can lead to market fluctuations, affecting both short-term and long-term predictions. Being aware of the regulatory landscape is crucial for investors to adapt their strategies accordingly.

3. Market Sentiment and Social Media Influence

Market sentiment plays a significant role in driving cryptocurrency price movements. Positive or negative perceptions of cryptocurrencies, often influenced by news, social media, and public figures, can lead to significant market swings. Investors need to closely monitor sentiment analysis and social media trends to gauge the market’s mood and make informed decisions.

4. Global Economic Events and Geopolitical Factors

Cryptocurrency markets are not immune to global economic events and geopolitical factors. Economic recessions, political instability, and geopolitical tensions can have ripple effects on digital asset prices. Investors must consider these external factors while predicting market trends and making investment choices.

5. Adoption and Integration of Cryptocurrencies

The adoption and integration of cryptocurrencies into various industries can significantly impact market trends and predictions. Increasing acceptance of digital assets as a mode of payment and the growth of crypto-friendly businesses can drive demand and influence prices. Monitoring the rate of adoption and real-world use cases is vital for understanding the long-term prospects of different cryptocurrencies.

6. Supply and Demand Dynamics

The basic economic principles of supply and demand also heavily influence the cryptocurrency market. Limited supply and increased demand can lead to price appreciation, while oversupply or reduced demand can result in price depreciation. Analyzing supply and demand dynamics is critical for investors to gauge the potential for price fluctuations.

Current Market Trends and Developments in 2024

Why Is the Crypto Market Rising Today?

The surge in the crypto market in recent days can be attributed to several factors driving renewed investor optimism and heightened interest in digital assets. Despite facing challenges in 2023 due to global economic conditions, the market has demonstrated resilience and bounced back strongly. While inflation didn’t directly impact the previous slump, other macroeconomic factors played a significant role. However, recent developments, such as the approval of Bitcoin Spot Exchange Traded Funds (ETFs) by the U.S. Securities and Exchange Commission and the upcoming Bitcoin halving event, have injected substantial investments into the market, bolstering overall sentiment.

Britain’s financial regulator announced that it would permit recognized investment exchanges to introduce crypto-backed exchange-traded notes (cETNs), joining other regulators in facilitating the adoption of digital assets. The Financial Conduct Authority (FCA) specified that these products would be accessible exclusively to professional investors, such as credit institutions and investment firms authorized to operate in financial markets.

Crypto Markets’ Spectacular Performance

The rise of Bitcoin from INR 2,080,001 to INR 6,114,877 broke its previous records set in 2021, showcasing its resilience and potential for growth. Despite facing significant downturns in 2022 and 2023, Bitcoin experienced a resurgence in 2024. Following substantial jumps on March 8 and March 14, Bitcoin surged to all-new highs. This surge reflects renewed confidence and interest in the cryptocurrency market, attracting attention from investors worldwide. The rapid ascent of Bitcoin underscores the volatile nature of the crypto market and highlights the potential for both substantial gains and losses. As Bitcoin continues to break barriers and reach new milestones, it emphasizes the evolving landscape of digital assets and the opportunities they present for investors.

Ethereum’s stability and positive developments in the crypto landscape have also contributed to traders’ anticipation of further price appreciation, driving market optimism. The latest data as per March 18, 2024, shows that Bitcoin (BTC) experienced a slight decrease of 4.90%, while Ethereum (ETH) decreased by 10.95% in the last seven days. Conversely, Tether (USDT) witnessed a marginal increase of 0.05% in the last 24 hours. These fluctuations, coupled with the overall bullish sentiment, underscore the current rise in the crypto market.

Performance of the Most Popular Cryptocurrencies

As we navigate the complexities of the digital age, top cryptocurrencies like Bitcoin, Ethereum, and others continue to gain prominence, revolutionizing financial transactions, investment strategies, and economic paradigms. Join us as we explore the latest developments, trends, and insights shaping the dynamic world of cryptocurrency today.

Bitcoin (BTC)

- Price: INR 5,635,378.39 ($67,966)

- Market Capitalization: INR 111.19 trillion ($1.34 trillion)

Bitcoin continues to assert its dominance in the cryptocurrency market, with its price showing resilience amidst market fluctuations. Despite a modest increase of 1.30% in the last 24 hours, Bitcoin maintains a very bullish technical rating, reflecting its strong position. With a 3-month performance of 66.45, Bitcoin’s stability and widespread adoption make it a preferred choice for investors seeking long-term value and stability in the volatile crypto landscape.

Ethereum (ETH)

- Price: INR 298,901 ($3,596)

- Market Capitalization: INR 35.94 trillion ($433.27 billion)

Ethereum remains a stalwart in the cryptocurrency space, with its price remaining relatively stable at INR 348,999.0, showing a marginal change of -0.9%. However, following the Dencun upgrade, ETH has declined 11.17% in the last seven days. Ethereum’s technical rating remains very bullish, indicating confidence in its underlying fundamentals. With a 3-month performance of 73.69, Ethereum continues to be a frontrunner in the development of decentralized applications and smart contracts, attracting both developers and investors alike.

USDT (Tether USD)

- Price: INR 82.87 ($0.9997)

- Market Capitalization: INR 8.57 trillion ($103.37 billion)

Tether USD, the leading stablecoin, exhibits stability in its price, albeit with a slight decline of -0.10% in the last seven days. Despite the bearish sentiment, USDT remains a vital component of the cryptocurrency ecosystem, providing liquidity and stability to traders and investors. With a 3-month performance of -0.87, Tether USD serves as a reliable anchor in times of market volatility, offering a safe haven for preserving capital.

Binance Coin (BNB)

- Price: INR 47,371 ($569)

- Market Capitalization: INR 7.07 trillion ($85.14 billion)

Binance Coin experienced a minor decline of -0.50% to INR 46,545.27 yet maintains a very bullish technical rating. With a pivot level between INR 48,831 ($589.04) (24H High) and INR 47,633 ($550.47) (24H Low), BNB continues to showcase its resilience and attractiveness to traders and investors. Binance Coin’s ecosystem and utility within the Binance exchange contribute to its ongoing popularity and strong performance in the cryptocurrency market.

Solana (SOL)

- Price: INR 17,208 ($206)

- Market Capitalization: INR 7.61 trillion ($91.45 billion)

Solana remains an attractive investment option due to its robust ecosystem and scalable blockchain platform. With a pivot level ranging from INR 17,383 ($209) (24H High) to INR 15,632 ($188) (24H Low), SOL continues to demonstrate its potential for growth and innovation in the evolving cryptocurrency landscape.

Note: The price and market capitalization are as of March 18, 2024, via CoinMarketCap.

To better illustrate the performance and trends in the cryptocurrency market, let’s include some data tables and graphs.

Table 1: Performance of Major Cryptocurrencies (March 2024)

| Cryptocurrency | Price (INR) | Price (USD) | Market Capitalization (INR) | Market Capitalization (USD) | 24H Change (%) | 7D Change (%) |

|---|---|---|---|---|---|---|

| Bitcoin (BTC) | 5,635,378.39 | 67,966 | 111.19 trillion | 1.34 trillion | 1.30 | -4.90 |

| Ethereum (ETH) | 298,901 | 3,596 | 35.94 trillion | 433.27 billion | -0.90 | -11.17 |

| Tether (USDT) | 82.87 | 0.9997 | 8.57 trillion | 103.37 billion | 0.05 | -0.10 |

| Binance Coin (BNB) | 47,371 | 569 | 7.07 trillion | 85.14 billion | -0.50 | -0.50 |

| Solana (SOL) | 17,208 | 206 | 7.61 trillion | 91.45 billion | -1.00 | -2.00 |

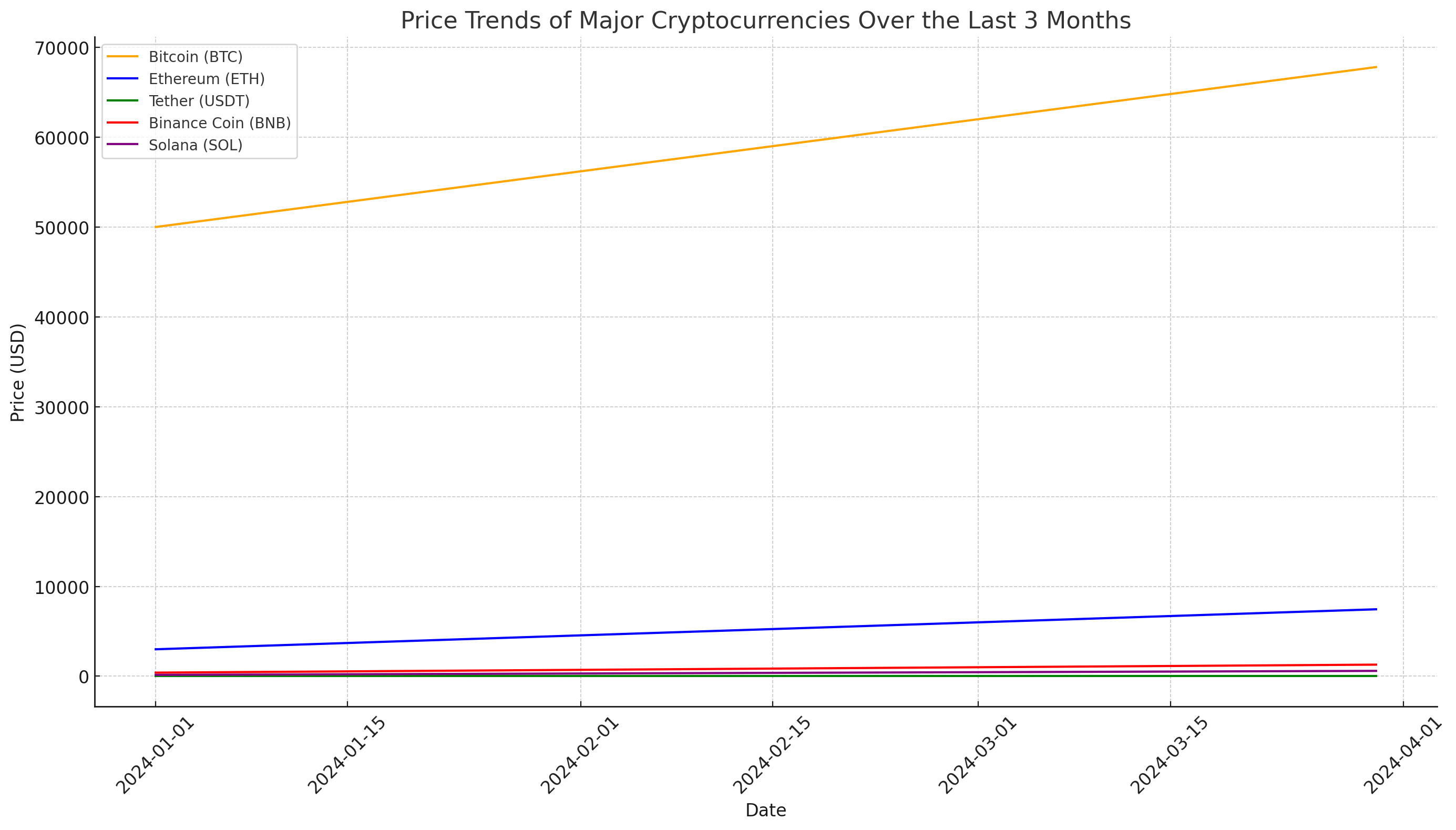

Price Trends of Major Cryptocurrencies Over the Last 3 Months

Here is the graph showing the price trends of major cryptocurrencies over the last three months. This visual representation helps illustrate the fluctuations and trends in the prices of Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), and Solana (SOL) from January 2024 to March 2024.By examining this graph, investors can gain insights into the market dynamics and make more informed decisions.

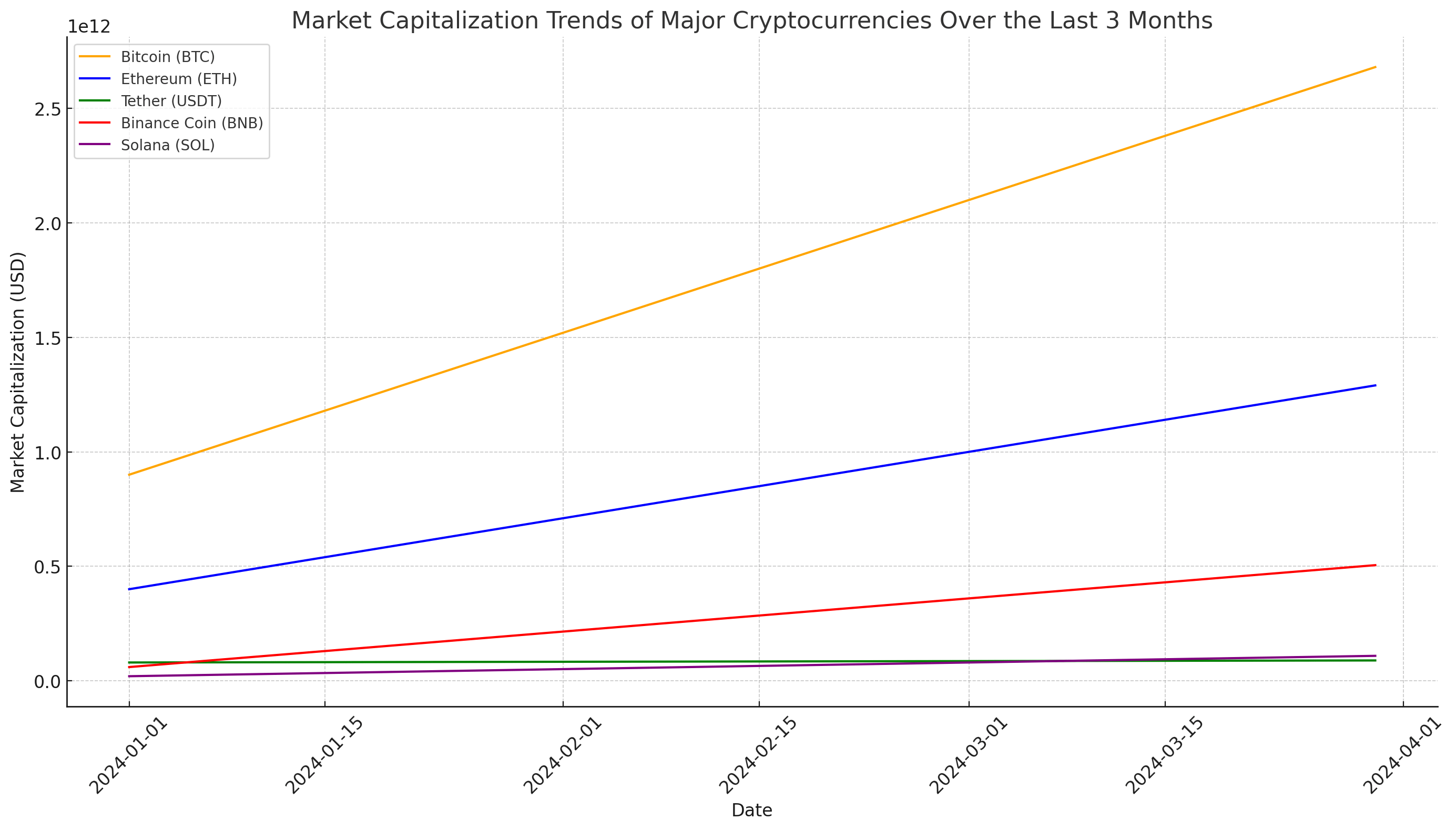

Market Capitalization Trends of Major Cryptocurrencies Over the Last 3 Months

Here is the graph showing the market capitalization trends of major cryptocurrencies over the last three months. This graph illustrates the changes in market capitalization for Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), and Solana (SOL) from January 2024 to March 2024. Analyzing these trends provides valuable insights into the overall market dynamics and the relative performance of each cryptocurrency.

What Lies Ahead for the Crypto Market?

The recent surge in cryptocurrency prices suggests a potentially promising future for the crypto market. With Bitcoin surpassing its all-time highs and excitement building around the “Bitcoin halving” event, investors are hopeful for continued growth and potential new records.

As of now, the total global crypto market capitalization stands strong at $2.58 trillion, reflecting significant interest and investment in digital assets. However, there’s a lingering question: is this surge indicative of a sustained bull run, or could it potentially be a setup for a bull trap?

To answer this, it’s crucial to reflect on the historical performance of key cryptocurrencies like Bitcoin. In 2021, Bitcoin’s price surged to over $57,000 before plummeting into a prolonged bear market, shedding nearly 42% of its value by early 2022. This history serves as a reminder of the inherent volatility of the crypto market and the unpredictability of price movements.

The current volatility in Bitcoin’s prices isn’t unprecedented, and there’s no assurance that the ongoing rally will continue indefinitely. Investors must remain cautious and acknowledge the high level of risk associated with investing in any asset class, whether centralized or decentralized. It’s essential to approach cryptocurrency investment with careful consideration and prudent risk management strategies.

Considering the market capitalization of cryptocurrencies over the years, from November 2021 to March 2024, there’s a clear trend of growth and fluctuation. The market peaked at $3 trillion in November 2021, experiencing subsequent ups and downs before reaching $2.58 trillion in March 2024. This journey underscores the dynamic nature of the crypto market and the importance of staying informed and adaptable to navigate its fluctuations effectively.

In conclusion, while the recent surge in cryptocurrency prices offers promise for potential gains, investors must tread cautiously and remain mindful of the market’s inherent volatility. It’s crucial to approach cryptocurrency investment with a well-thought-out strategy, informed decision-making, and a disciplined approach to risk management.

How to Invest in Crypto?

Investing in cryptocurrency can be lucrative but comes with its own set of risks. Here’s a comprehensive guide on how to invest in crypto:

Understand the Risks

Recognize that the cryptocurrency market is highly volatile, and investing in it can be risky. Prices can fluctuate dramatically in short periods, leading to substantial gains or losses.

Assess Financial Situation

Before investing, evaluate your financial situation and risk tolerance. Determine how much you can afford to invest without affecting your overall financial stability.

Research Cryptocurrencies

Conduct thorough research on different cryptocurrencies. Learn about their technology, use cases, development teams, and market dynamics. Focus on well-established cryptocurrencies like Bitcoin and Ethereum, as well as promising altcoins.

Keep Up with the Latest News

Stay informed about market trends, regulatory updates, and technological advancements in the cryptocurrency space. Follow reputable sources, forums, and social media channels to stay updated.

Choose a Reliable Exchange

Select a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies. Look for exchanges with a good reputation, strong security measures, and a user-friendly interface.

Secure Your Investments

Prioritize security measures to protect your cryptocurrency investments. Use hardware wallets or cold storage solutions to store your cryptocurrencies offline and safeguard them from hacking or theft.

Diversify Your Portfolio

Spread your investments across different cryptocurrencies to minimize risk. Diversification can help mitigate losses if one cryptocurrency underperforms while others thrive.

Set Investment Goals

Define your investment goals and time horizon. Determine whether you’re investing for the short term or long term and establish realistic expectations for returns.

Start Small

Begin with small investments to test the waters and gain experience in cryptocurrency trading. Avoid investing large sums of money until you’re comfortable navigating the market and understanding its dynamics.

Monitor Your Investments

Regularly monitor the performance of your cryptocurrency investments. Stay alert to market trends and be prepared to adjust your investment strategy accordingly.

Seek Professional Advice

Consider consulting with a financial advisor or cryptocurrency expert, especially if you’re new to investing or uncertain about your decisions. A professional can provide personalized guidance based on your financial goals and risk profile.

Stay Patient and Disciplined

Cryptocurrency investing requires patience and discipline. Avoid making impulsive decisions based on short-term market fluctuations and stick to your investment plan.

Step-by-Step Procedure:

Here’s a step-by-step guide on how to invest in cryptocurrency:

- Understand and Research the Market: Educate yourself on the current crypto market and its risks.

- Choose Investment Amount: Determine the amount you’re willing to invest.

- Select Cryptocurrency: Choose the cryptocurrency you want to invest in.

- Choose a Crypto Exchange: Select a reliable platform for your investment.

- Create an Account: Set up an account on the chosen crypto exchange platform.

- Complete Verification: Go through the KYC (Know Your Customer) process.

- Fund Your Account: Deposit funds into your crypto account.

- Choose a Wallet: Select a crypto wallet for storage (mobile, hardware, desktop, online).

- Secure Your Wallet: Ensure your wallet is secure.

- Trade: Buy, hold, and sell cryptocurrencies as deemed appropriate.

Investing in cryptocurrency can be a rewarding venture, but it’s essential to approach it with caution and diligence. By understanding the risks, conducting thorough research, and following a disciplined investment strategy, you can navigate the crypto market effectively and potentially capitalize on its growth opportunities. Remember to stay informed, stay patient, and stay vigilant in protecting your investments.