The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, introduced a historic overhaul of the income tax system, offering significant relief to the middle class and salaried employees.

The biggest announcement of this budget is the introduction of zero tax liability on annual income up to ₹12 lakh under the new tax regime. This is expected to benefit millions of taxpayers and improve disposable income, leading to higher savings and investments.

Let’s take a deep dive into the new income tax slabs, benefits, and key financial reforms introduced in the Union Budget 2025.

1. Major Change: No Income Tax on Income up to ₹12 Lakh!

One of the most groundbreaking reforms in Budget 2025 is that individuals earning up to ₹12,00,000 annually will not pay any income tax under the new tax regime due to a higher rebate.

For salaried individuals, the effective tax-free limit extends up to ₹12,75,000, factoring in the standard deduction.

Revised Income Tax Slabs for FY 2025-26

Below is the updated new tax regime structure:

| Income Range (Annual) | Tax Rate (%) |

|---|---|

| Up to ₹4,00,000 | No Tax |

| ₹4,00,001 to ₹8,00,000 | 5% |

| ₹8,00,001 to ₹12,00,000 | 10% |

| ₹12,00,001 to ₹16,00,000 | 15% |

| ₹16,00,001 to ₹20,00,000 | 20% |

| ₹20,00,001 to ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

🔹 Who Benefits?

- Individuals earning ₹12 lakh or less annually will pay ZERO tax.

- Salaried employees with income up to ₹12,75,000 are fully exempt, considering the standard deduction.

- The revised slabs ensure higher take-home salaries for middle-class taxpayers.

2. Key Income Tax Benefits in Budget 2025

🔹 Zero Tax for Middle Class (Biggest Relief!)

- The government has announced 100% tax rebate under Section 87A for individuals earning up to ₹12 lakh annually.

- This move is expected to benefit over 6 crore taxpayers and boost consumption and investments.

🔹 Standard Deduction Remains Same in Both Regimes

- Salaried and pensioners continue to receive a standard deduction of ₹75,000.

- This means salaried employees earning up to ₹12,75,000 will effectively pay zero tax.

🔹 Higher Tax-Free Limit

- The tax-free limit under the new tax regime has been increased from ₹3 lakh to ₹4 lakh, ensuring more savings for low-income taxpayers.

🔹 Extended Tax Rebate for Young Earners

- The government has extended tax relief for first-time job seekers and young professionals by offering rebates for those earning up to ₹12 lakh annually.

🔹 Simplification of Income Tax Filing

- The deadline for filing updated tax returns has been extended from 2 years to 4 years, ensuring more flexibility for taxpayers.

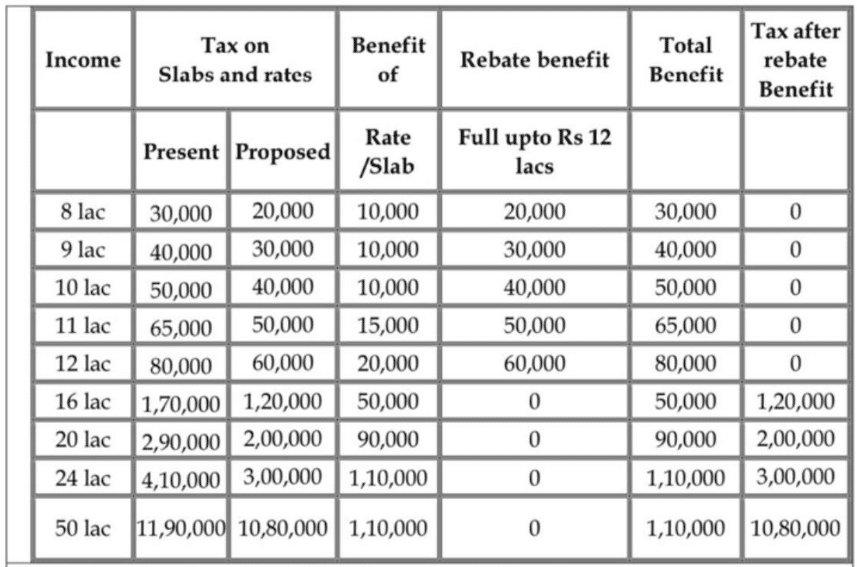

3. How This Budget Benefits Different Income Groups

With the revised tax slabs, taxpayers across different income brackets will see major savings. Here’s an impact analysis:

🔹Who Saves the Most?

- Middle-class professionals (earning ₹8–₹12 lakh) will see the biggest savings.

- Salaried employees with income up to ₹12.75 lakh will pay zero tax.

- High-income earners will also benefit from lower tax rates on slabs up to ₹24 lakh.

4. Other Major Financial Reforms in Budget 2025

📌 TDS & TCS Rationalization

- The TDS threshold on rental income has been increased from ₹2,40,000 to ₹6,00,000.

- TCS on foreign remittances has been revised, easing compliance for international transactions.

📌 Support for Senior Citizens

- Tax-free interest income for senior citizens doubled from ₹50,000 to ₹1,00,000 under Section 80TTB.

- This ensures higher post-retirement savings.

📌 Tax Relief for Homebuyers

- Taxpayers can now claim tax exemption on two self-occupied properties.

📌 Boost for Startups & MSMEs

- Tax exemptions for startups extended for 5 years.

- Easier GST compliance for small businesses.

5. Conclusion: The Most Taxpayer-Friendly Budget Ever?

The Union Budget 2025 is one of the most taxpayer-friendly budgets in Indian history, ensuring higher take-home income and simplified taxation.

Key Takeaways:

✅ Zero tax on income up to ₹12 lakh (₹12.75 lakh for salaried employees)

✅ Lower tax rates on all slabs under the new tax regime

✅ Higher disposable income for middle-class taxpayers

✅ Tax relief for senior citizens & entrepreneurs

✅ More disposable income → Higher investments → Economic growth